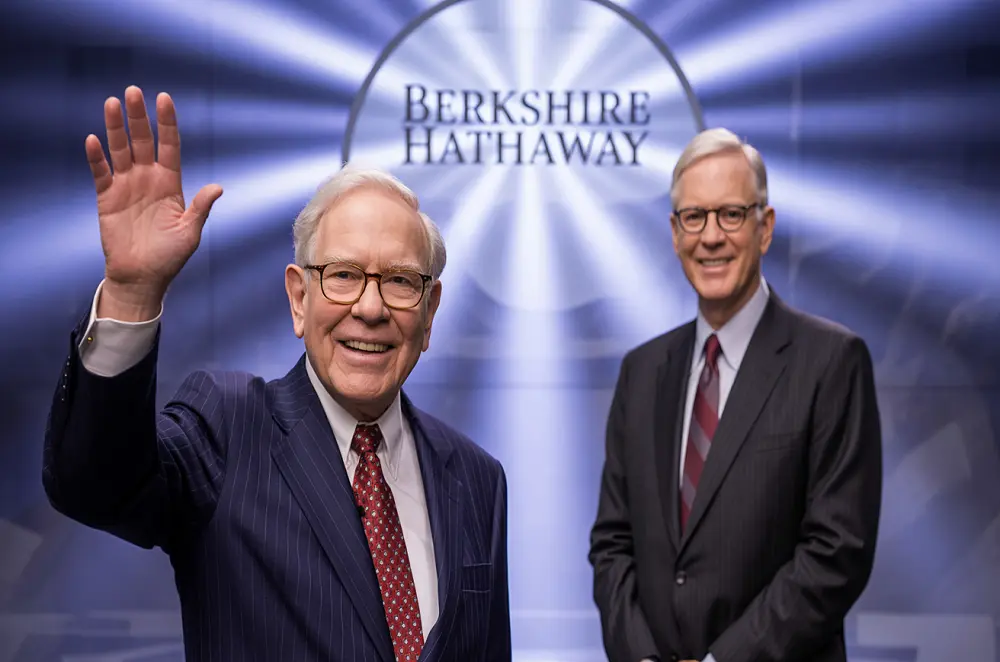

Shareholder meeting that he will step down as CEO by the end of the year. His successor has been named Greg Abel, who is currently the vice president of the company’s non-insurance operations. Buffett made it clear that he will continue as the chairman of the board and retain his shareholding.

Table of Contents

- Warren Buffett’s Departure and Greg Abel’s Appointment

- Buffett’s Comments on Trade Policy

- Berkshire Hathaway’s Investment Strategy

- Concerns Over AI Fraud

- Positive Outlook Towards India

- Conclusion

Buffett's departure and Abel's appointment

Buffett said that the information about his successor was known only to his children, who are on the board. He expressed faith in the economic potential of the US and said, “Being born in America was the luckiest day of my life.”

Buffett's comments on trade policy

Buffett criticized tariffs imposed on trade and called them a threat to global stability. He said that the US should embrace global trade, not fear it. On the recent volatility in the market, he said that even a 50% drop would not bother him; He sees it as a “fantastic opportunity”.

Berkshire's investment strategy

Buffett revealed that Berkshire Hathaway, which is currently sitting on $330 billion in cash, was recently close to making a deal worth about $10 billion, which ultimately did not happen. He told that the company is ready to invest in line with the value.

Join The Quantitative Elite Community here: The Quantitative Elite on Skool

Cuts stake in Apple

Berkshire Hathaway has cut its stake in Apple by 13%, taking the total value of its stake to $135.4 billion. Buffett praised Apple, saying that the company is “still our largest holding” and he called it “the best product ever made”.

Concerns over AI fraud

Buffett expressed concern over potential fraud through artificial intelligence (AI). He said that with the help of AI, it could be easier to deceive people by creating fake images and messages, making it “the biggest fraud industry ever”.

Positive outlook towards India

Buffett expressed a positive outlook about India and said that “there are a lot of opportunities in places like India”. However, he also clarified that Berkshire does not have immediate plans to make big investments in other countries.

Conclusion

Warren Buffett’s departure and the appointment of Greg Abel signal the beginning of a new era for Berkshire Hathaway. Buffett’s investment strategy, his views on global business, and his comments on the potential dangers of AI are important signals for investors.

Grab your copy of Practical Python for Effective Algorithmic Trading here: Amazon – Practical Python for Effective Algorithmic Trading