Revolution in Algorithmic Trading: The Role of Python and Pandas

Algorithmic trading has changed the definition of financial markets in today’s world. Whether you are a quantitative trader in Singapore, a crypto investor, or looking for the best trading software in the US – one thing will always be with you, and that is the Pandas library.

What is Pandas and why is it important?

Pandas is a Python library that is extremely important for data analysis, data cleaning, time series analysis, and trading strategy backtesting. Whether the data is of green candles or red, Pandas always comes in handy.

Main uses of Pandas:

- Data analysis and manipulation

- Time series analysis

- Data cleaning and preprocessing

- Strategy backtesting

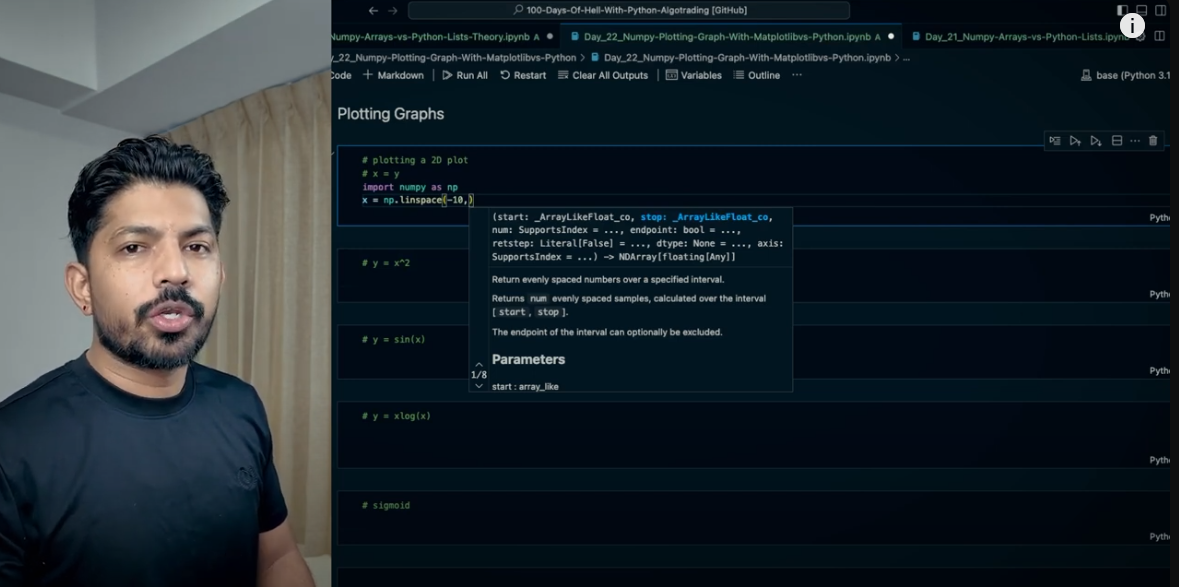

- Data visualization (with Matplotlib and Seaborn)

What is OHLC data? (Open, High, Low, Close + Volume)

OHLC data is mainly used for trading:

- Open: Where the price started in a given time

- High: The highest price at that time

- Low: The lowest price at that time

- Close: The end price at that time

- Volume: Total trading volume

Meaning of 🟢 green and 🔴 red candles

- Green candle: If Open < Close, that means the price has increased

- Red candle: If Open > Close, that means the price has decreased

Each candle represents a time period – for example, a 1-hour candle includes the High, Low, Open and Close prices of that one hour.

Market Phases: Manipulation, Accumulation, Distribution

Trading charts have a few major phases:

- Manipulation Phase – A trend is set by playing with prices

- Accumulation Phase – Where large investors buy the stock slowly

- Distribution Phase – Investors sell their shares, which can cause the price to drop

How does a Pandas DataFrame work?

A Pandas DataFrame is similar to a table – with columns and rows. Each column is a Pandas Series.

Example:

import pandas as pd

import numpy as np

price_data = [

[100, 200, 300],

[400, 500, 600]

]

df = pd.DataFrame(price_data)

This code will create a simple DataFrame. Pandas lets you easily filter, analyze, and visualize data.

How to identify whether a candle is green or red?

Using Pandas, you can also determine whether a candle is green or red. For this:

if df[‘Open’] > df[‘Close’]:

print(“Red Candle”)

else:

print(“Green Candle”)

Backtesting and Algo Strategy

Backtesting is an important part of algo trading. With Pandas, you can test your strategies on historical OHLC data.

Freqtrade Strategy

Freqtrade is an open-source crypto trading bot that backtests and optimizes your strategy using Pandas.

Data Cleaning and Removing Unnecessary Columns

By removing unnecessary columns from the data (e.g. Company Name, Sector, Industry), you can focus only on the columns that matter (e.g. Open, Close, Volume):

df.drop([‘Company Name’, ‘Sector’, ‘Industry’, ‘Market Cap’], axis=1, inplace=True)

Conclusion: Pandas are the backbone of Algo Trading

If you want to master Algo Trading, learning Pandas is a must. Whether it is OHLC data, candle analysis, or backtesting – Pandas is with you every step of the way.

Through this video series, you will learn to use Pandas as a powerful weapon that will help you face any trading challenge.

10/20