Nanosecond Market Data Delivery for Ultra-Low Latency Trading

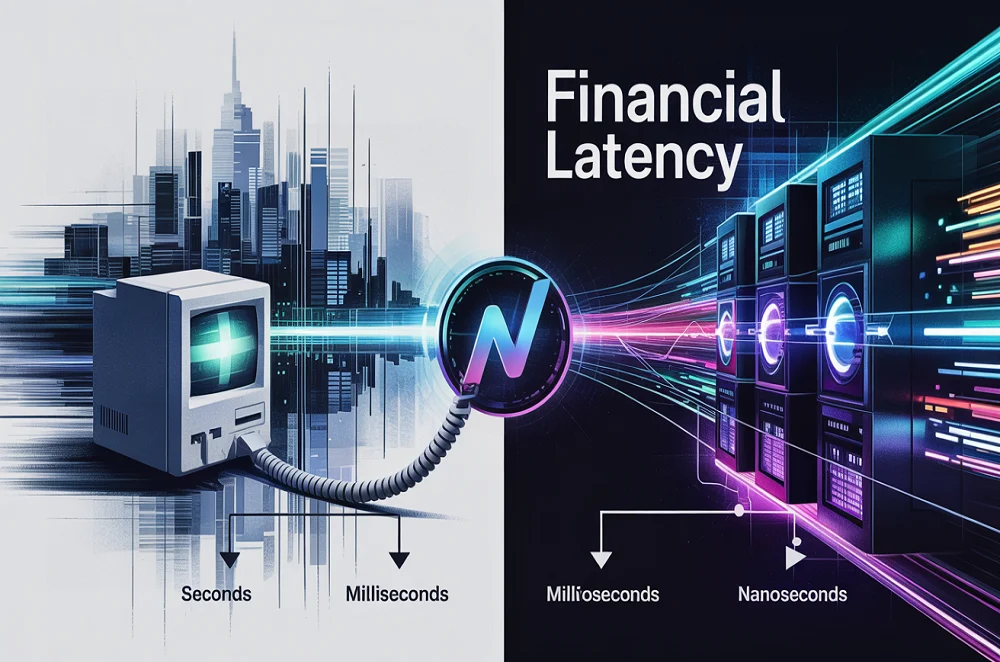

Our exploration of the trading speed race has taken us from seconds to milliseconds, into the microsecond era of High-Frequency Trading (HFT) and Co-location, and right up to the absolute edge of Sub-Microsecond Execution within the Relativistic Trading Regime. We’ve seen how firms optimize every millimetre of the Trading Pipeline Optimization and harness Hardware Acceleration […]

Nanosecond Market Data Delivery for Ultra-Low Latency Trading Read More »