Become an Algo Trading Expert in 100 Days – Day 1 Starts with Python

Do you want to learn algorithmic trading? If yes, you can become an expert algo trader in the next 100 days — and the journey begins with Python.

What is Python?

Python is a high-level interpreted programming language known for its clean and simple syntax.

Not only is this language easy to read, but writing code in it is also quite beautiful and straightforward.

Interpreted vs Compiled Language

Interpreter: Python reads and runs the code line by line. That is, as soon as you write a line, it can be run immediately.

Compiler: On the other hand, the compiler first reads the entire program at once, then runs it.

Features of Python

Multi-paradigm support: You can code in all three ways in Python – procedural, object-oriented, and functional.

Object Oriented Programming (OOP): We will learn OOP in detail in the upcoming video.

Flexibility and Versatility: Python can be used for web development, data analysis, artificial intelligence, scientific computing, and more.

Why Python for Algo Trading?

- Easy to Learn: Python is such an easy language that anyone can learn it and start programming in 1-2 weeks.

- Close Relation to Math: Python has many pre-built mathematical modules that make your coding easier and faster.

- “Batteries Included” Philosophy: Python already has many built-in functions — like you can reverse a string with just one line.

- Library and Community Support: Libraries like NumPy, Pandas, Matplotlib and a strong developer community make it even more powerful.

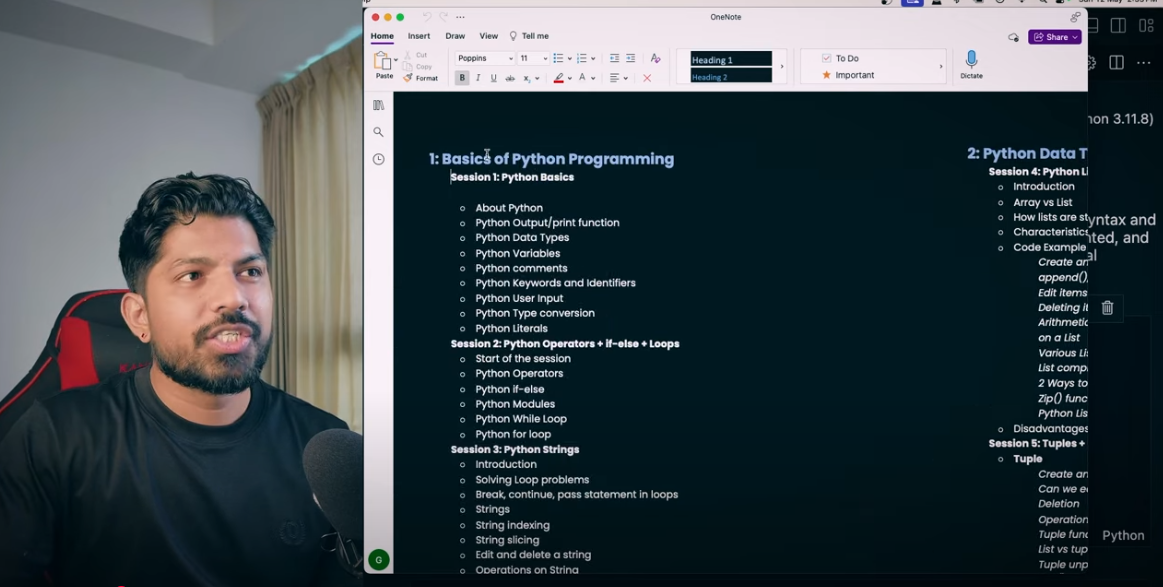

100 Days Algo Trading Plan

We will cover these topics in the next 100 days:

Day Topic

1–10 Basic Python Programming

11–20 Python Data Types

21–30 Object Oriented Programming

31–40 Advanced Python

41–50 Beginning NumPy and Pandas

51–60 Advanced Pandas

61–70 Data Visualization

71–80 Data Analysis Techniques

81–100 Real World Algo Trading Projects

Watch this Day 1 video tutorial

Best Python Libraries for Algo Trading:

Pandas & NumPy – Data analysis & handling

TA-Lib – Technical indicators for quantitative analysis in Singapore

Freqtrade – Open-source crypto trading bot

Setting Up Your Algorithmic Trading Environment

Step 1: Install Python & Required Libraries

pip install pandas numpy ta freqtrade

Step 2: Set Up a Trading API (Binance, Coinbase, etc.)

Step 3: Implement a Basic Trading Strategy

import pandas as pd

data = pd.DataFrame({‘Price’: [45000, 46000, 47000], ‘Moving_Avg’: [45500, 45700, 46500]})

data[‘Signal’] = data[‘Price’] > data[‘Moving_Avg’]

print(data)

Introduction to Freqtrade Strategy for Crypto Trading

Freqtrade is one of the best algorithmic trading software in the USA for automating crypto trades.

How to Install Freqtrade?

git clone https://github.com/freqtrade/freqtrade.git

cd freqtrade

./setup.sh –install

How Freqtrade Helps?

Supports backtesting & paper trading

Implements custom crypto trading strategies

Ideal for quantitative traders in Singapore & the USA

Developing a Simple Trading Strategy

Using RSI Indicator for Trade Execution

import talib

# Sample price data

prices = [45000, 45500, 46000, 47000, 46500]

# Calculate RSI

rsi = talib.RSI(prices, timeperiod=14)

if rsi[-1] < 30:

print(“Buy Signal”)

elif rsi[-1] > 70:

print(“Sell Signal”)

6. Backtesting & Optimizing Your Trading Strategy

What is Backtesting?

Backtesting helps traders test their strategies using past data before deploying them live.

How to Backtest in Freqtrade?

freqtrade backtest –strategy MyStrategy

Go ahead—challenge yourself and solidify your learning!

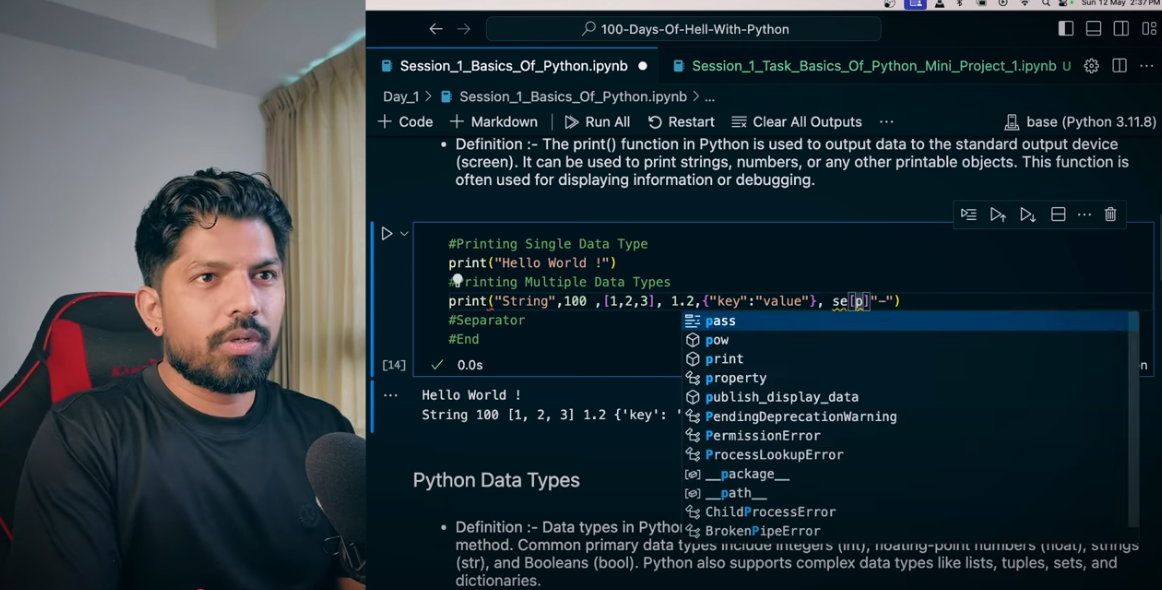

Day 1: Python Basics

![]()