Day 21: Python List vs Numpy Array – What is the real difference between Algo Trading?

If you want to learn Algorithmic Trading in Python, then one of the most important topics is – the real difference between Python List and Numpy Array. Knowing this difference can be a game changer for you, especially when you are creating crypto trading strategies in the USA or doing quantitative analysis for trading in Singapore.

Why is Numpy Array important for Algorithmic Trading?

Numpy is designed in such a way that it uses memory efficiently and executes high-performance operations very quickly. This is the reason why most of the best algorithmic trading software in the USA and quantitative trading firms in Singapore use Numpy Array instead of Python List.

Python List vs Numpy Array – How is data stored in memory?

When you use a Python List, each item is stored at a different memory address.

For example:

If there are 1, 2, 3, 4 in a list

Python stores a separate address for each element.

Whereas in Numpy array, all the values are stored in a continuous block of memory and hence mathematical operations can be performed faster.

Data Type Consistency – Flexibility of Python List becomes a Weakness

The specialty of Python List is that you can put any data type in it – integer, float, string, everything together.

But in Algorithmic Trading, this flexibility becomes a weakness.

- If your list contains mixed data types and you perform any numerical operation, it may give an error.

- For large datasets (such as 14 years of stock price data) it may show unexpected behavior.

All elements in a Numpy array are of the same data type

Numpy automatically ensures that its array is made up of the same type of data — and that is why it is fast and reliable.

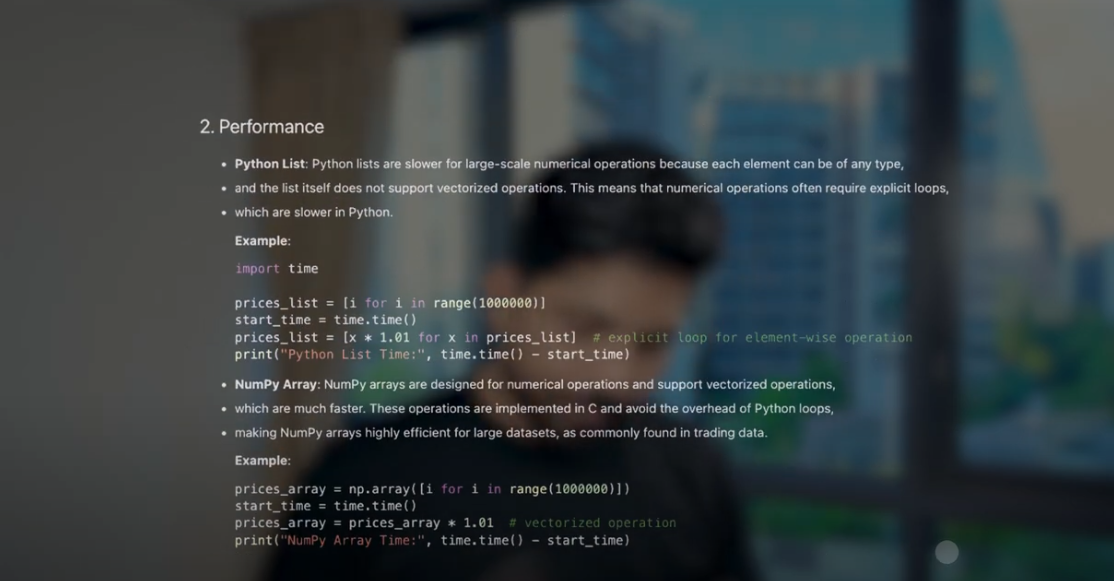

How does Numpy array give an edge in performance?

Numpy array is many times faster than Python List.

Why?

- Python List does not support vectorized operations.

- So you have to use loops, which are slow in Python.

- On the other hand, in Numpy you can perform mathematical operations on the entire array at once.

Example:

If you have Apple stock price data from 2010 to 2024, then it can be a dataset of millions of rows.

With Python List, computation in it will be very slow,

While Numpy array can process this data in just a few milliseconds.

Power of C Language – Why is Numpy Faster?

The backend of Numpy is written in C language, which is many times faster than Python.

This means that when you perform any operation on Numpy Array,

it runs at the speed of C code, not Python code.

That is why Numpy is also called “Python’s High-Speed Library”.

Practical Example – Difference in Execution Time

Python List:

my_list = [i for i in range(1000000)]

result = [x * 2 for x in my_list]

Numpy Array:

import numpy as np

my_array = np.arange(1000000)

result = my_array * 2

In the above two examples, the operation on Numpy Array will be executed many times faster than Python List.

Watch this Day 21 video tutorial

Day 21: Advanced Numpy

![]()

16/20