Day 15 Journey: Python File Handling and the Power of Algorithmic Trading

Algorithmic Trading with Python: The Game-Changer of Modern Trading

Algorithmic trading i.e. automated trading is revolutionizing the financial world today. With the help of a simple but powerful programming language like Python, quantitative traders can create complex trading strategies.

This technology makes trading faster, more accurate and less emotional.

Whether it is crypto trading, high-frequency trading or long-term quant strategies — Python is useful in every field.

Best Algorithmic Trading Software in USA

If you live in the US or want to trade in the markets there, then these tools are a must know:

- Freqtrade – Open-source and free crypto trading bot

- QuantConnect – Institutional-grade backtesting and live deployment

- Zipline – The most trusted Python library for backtesting

- Trality – Drag-and-Drop Bot Builder for beginners

All of these allow you to create your own strategies using Python.

Quantitative Analysis for Trading in Singapore

Quantitative Analysis is growing rapidly in developed markets like Singapore. With Python:

- Analyze historical data

- Customize technical indicators

- Backtest and automate strategies

Freqtrade Strategies: Learn and apply

With Freqtrade you can easily:

- Train your trading bots with historical data

- Store data in JSON or CSV

Use indicators like RSI, MACD, and Bollinger Bands

Python File Handling in Algorithmic Trading

Why is File Handling important?

In Algo Trading, we deal with many types of files — such as:

.csv (trade data)

.json (config)

.log (trading logs)

Binary files (special data formats)

It is important to have knowledge of Python File Handling so that you can store, process and record data properly.

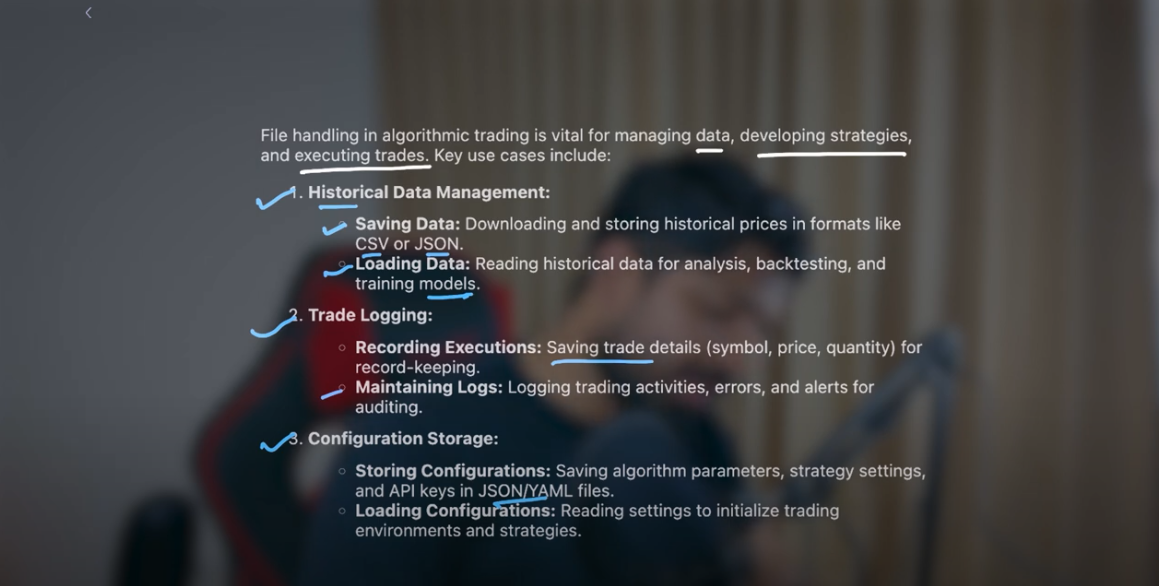

Use Cases of File Handling in Algo Trading

1. Historical Data Management

- Downloading data from the market and storing it in .csv or .json format

- Later using it for analysis, backtesting and machine learning

- with open(“price_data.csv”, “r”) as file:

- data = file.readlines()

2. Loading Data for Analysis

- Reading data from files and using it in libraries like Pandas

- This data helps in model training and strategy testing

- import pandas as pd

df = pd.read_csv(“trade_data.csv”)

3. Trade Logging & Record Keeping

- Logging every trade information: Symbol, Price, Quantity

- Keeping error logs so that debugging is easy

- with open(“trade_log.txt”, “a”) as log:

- log.write(“Buy BTC at $42000\n”)

4. Configuration Storage (JSON/YAML)

Storing API Keys, Strategy Parameters and Settings in .json or .yaml files

This is useful in Automation

{

“api_key”: “ABC123”,

“max_trade”: 5,

“strategy”: “RSI”

}

The blogger told that he is waking up at 2 am every day and creating videos and content so that no day is missed in this series. This dedication leads any trader or developer to success.

“If you become 1% better every day, then after 100 days you will have changed 100%.”

Watch this Day 15 video tutorial

Day 15: File Handling

![]()